Designing More Equitable Digital Health Interventions

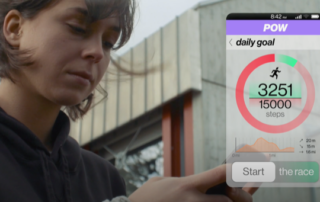

Effective digital health interventions may need to address a broad set of barriers in order to help a diverse population change behaviors. Layering the Double Diamond model of design with a behavioral design process ensures the inclusion of a comprehensive set of behavior change techniques in an intervention. Coupled with personalization technology, this approach can make digital health more equitable.