By Michael Ryan

Economists have historically been enamored with Market Theory and Equilibrium. The notion that “The Market” tends towards a stable state has been more panacea than an effective tool for explaining many facets of our economy. The classical focus on markets and some invisible hand ignores human behavior, profits, debt and financial health of businesses or consumers. Just ask yourself: how can the study of economics exclude behavior, profits and debt?

A fresh start with “Behavioral Economics” coupled with a proposed economic perspective called “Value Creation and Exchange” promises a more thorough understanding of our economy. The new approach draws a parallel between Economic Value and Economic Energy. Every single sale is an individual spark of energy that makes the economy move. The force behind a sale is a subjective force driven by human behavior; motivation.

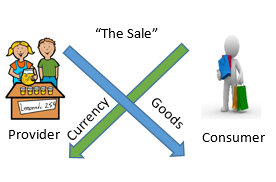

A simple diagram of “the sale” shows currency flowing in one direction and goods flowing in the opposite direction. This is an exchange of “energy” in the form of currency or the value of goods. As in physics, power is the rate of this exchange.

Consumer’s View

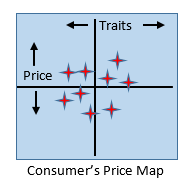

Examining something simple like the purchase of a cup of coffee is an excellent entry. The foundation for the consumer’s behavior is the individual’s perceived fair price for a cup of coffee. In this case, an avid coffee consumer is aware of the price and characteristics of coffee from the various sources available on the way to work. The consumer establishes a “price map” for a cup of coffee over a period of time from his environment by stopping at various places, speaking with friends or observing signage/advertising. The map is imprecise as memories are not precise. The map may be complicated, as some coffee shops include great pastry choices, while others may have a comfortable lounge area with free wi-fi. The complications are simply a form of product differentiation, a key tool for competition.

The consumer’s price map balances traits and price.

In the end, the consumer establishes the concept of a “fair price” from his “price map”. In Behavioral Economics this is the establishment of a “Reference Price” or “Reference Dependence”.

However, the consumer’s behavior is not a static interpretation of the “price map”. Various environmental factors either increase the need or interest in a product or decrease the need/interest. For a cup of coffee the most notable positive influence on value is the need to wake up!! The most notable negative influence on value would be satiation or the need to go to sleep. This fleeting view of “need” is best described as “Temporal Value”.

The Combination of “Temporal Value” and “Reference Price” creates a gap called “Consumers Economic Potential”. This potential is the motivating force for consumer behavior resulting in a purchase.

Two factors that can increase the gap would include a sales price or advertising. Both stimulate demand and result in a higher rate of sale to the market.

Provider’s View

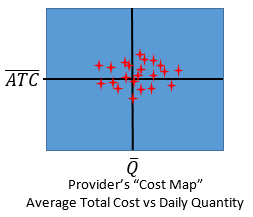

The provider will have a similar construct from the other side of the transaction. From daily production reports on sales the provider receives a steady stream of cost information. The provider is aware of historical performance and just as the consumer has a price map, the provider will develop a cost map. (ATC, Average Total Cost vs: Quantity)

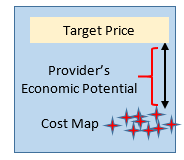

The providers cost map is used to establish the Target Price.

Over time, the provider establishes a “Reference Dependence” based upon the “cost map” that will be used for making business decisions. Constant monitoring of actual costs and sales performance keeps the firm profitable.

Just as the consumer compares Temporal Value to Price, the provider will compare his “Reference Cost” to “Target Price”. The difference between these two is the “providers economic potential”. This potential for a profit is the motivating force for the provider.

The Micro-engine of Economics

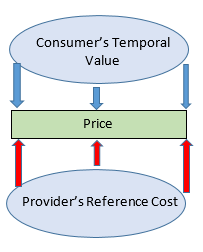

Pulling together the two respective views reveals the total economic potential for a sale. There are two conditions required for a regular exchange of goods and money to take place:

- Consumers are motivated by needs and will freely act when their perceived temporal value is equal to or greater than price

- Providers are motivated by profits and will act when the target price is higher than their perceived costs.

The proposed definition of Economic Potential for the behavioral model would be:

Total Economic Potential = Consumer Potential + Provider Potential

Consumer Economic Potential = Consumers Temporal Value – Reference Price

Provider Economic Potential = Target Price – Reference Cost

Given these potentials are mental creations, they are subjective and can’t be measured. There is no way to apply a “voltmeter” and obtain a measurement. But they do affect behavior and are the source of “motivational forces” that drive the economy.

The Physics of it All

Early economists craved legitimacy in the scientific community. They borrowed rules from physics even when the rules did not match economic reality. A great example is the use of a quadratic equation for modeling Marginal Cost. This is a direct mirror of Newton’s law of motion governing falling objects. Even though these models have been proven to be invalid they are still taught to millions of students each year. Arguments against the models have been dismissed by economists like Friedman, “Such a theory cannot be tested by comparing its “assumptions” directly with “reality.”

Even though these applications are incorrect and should be discarded, there are other parallels in Physics worth exploring.

Energy, Potential Energy, Force and Work… Consider the following parallels:

| Physics | Economics | |

| Energy | Electrical Energy, kinetic energy, chemical energy… The “ability” to do work – The ability to do “something”. | Money or Goods – something of “value”. Savings, investments, retained earnings, money in the bank. The ability to do “something” |

| Potential Energy | A relative measure of the energy levels. | A relative measure of value. A measure of economic potential. Profit Margin or difference between temporal value and price. |

| Work | Force times distance – what you get for “your energy”. Doing something | Labor applied. What a provider gets for their wages paid. |

| Force | The result of a difference in potential energy | Motivation – the result of basic needs, profit opportunity motivates the businessman, positive consumer potential motivates the buyer, salary motivates the worker |

It is important to note the limitations between these comparisons:

- Mass – there is no concept of mass in economics – there is no F=MA equation. Economists should not use Newton’s quadratic equation for acceleration to model Marginal Cost.

- In Physics, energy isn’t created or destroyed but is transformed. In Economics energy/value is transformed from labor to cash to goods. In Economics, energy in the form of added value is created all the time.

Key Attributes of Energy and Value in Economics

As in physics, the components in economics: energy, value, money and work can transform from one to the other. Work, Money and Items of Value are equivalent. Work draws a salary, Work creates added value. Static energy exists on the balance sheet of a corporation in the form of investments and physical assets. Just like a battery provides reserves, the same is true for a strong balance sheet. Kinetic energy is work applied, where added value is created in the production process, when an item is exchanged for cash.

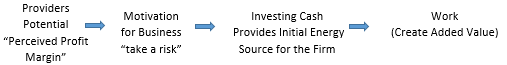

The economic transformation consists of two opposing flows. Goods or items of value move in one direction and cash/value moves in the opposite direction. The system requires a positive economic potential for both the consumer and the provider in order to have an exchange of goods. The existence of Provider’s Potential is the spark for the business. Providers Potential is the initial “force” that leads to action.

The Value Creation Model and the Life of a Firm

However, provider’s economic potential is simply gross margin. This is not enough for a firm to survive. It is not enough to attract competition. It is only potential/opportunity. The business has to convert the potential into sustainable profits that provide a reasonable return on investment. Sustaining profits is equivalent to storing energy.

Consider the initial spark and how this leads to a successful business;

Once the entrepreneur takes the risk and invests funds into a firm, the life cycle starts. The life of the firm is dependent upon the energy flows through the firm. Cash value flows are shown in green and goods value flows are shown in red. As long as the net energy into the firm is positive, the firm will survive. Healthy energy stores on the balance sheet allow the firm to survive difficult times. Unhealthy energy levels on the balance sheets can lead to the death of the firm.

The Value Creation Model: Firms survive when they create added value and make a profit.

Three key items to draw from this diagram:

Three key items to draw from this diagram:

- A company’s Balance Sheet is a report on the firms level of stored energy

- A company’s Income Statement is a report on the firms energy in motion

- These two standard accounting reports along with market opportunities and threats drive behavior

On first pass, the Value Creation Model may seem to be stating the obvious. However, nothing of the sort is taught in today’s introductory economics classes.

In the standard ECON 101 class, economists claim that firm behavior is driven by rational people thinking of Marginal Costs and Marginal Revenue. However, the measure of Marginal Cost or Marginal Revenue are not available via normal business accounting reports. Something that can’t be seen or felt will not drive behavior.

This model eliminates the divide between economists and accountants and allows economics to be a natural entry into standard business decision making. Students will no longer have to learn that economists think differently than accountants.

This model provides insight into the risks of running a business. There is a clear time delay between investment, parts acquisition, manufacturing and finally the sale. Many things can go wrong through this process resulting in losses.

The model provides insight into the ever present push and pull between the labor work force demand for wages and the need to keep costs to a minimum to ensure profits and the livelihood of the firm.

This model shows the role of debt in a firm. Debt should be used primarily for financing of assets that are part of the production process. Debt used solely for speculation is a sign of weakness. History shows that firms that have been part of leveraged buy outs are generally less healthy than firms with properly applied debt. WorldCom, TXU and Macy’s are examples where new debt crippled the firm’s ability to remain profitable.

It is time for us to teach economic theories that have valid assumptions reflecting what happens in a real business. It is time for our economic theories to honestly display the strengths and the weaknesses of a capitalistic system. It is time to retire Neoclassical Economics. Only then can we have an informed public discussion about policies that affect our economic opportunities.