The Three Laws of Human Behavior

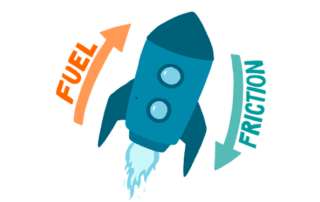

Human behavior is remarkably complicated. And yet, just as Newton's laws of motion distill three fundamental truths about the physical world, the three laws of human behavior describe three fundamental truths of human behavior: People tend to stick to the status quo unless the forces of friction or fuel push us them off their path; behavior is a function of the person and their environment; every decision includes tradeoffs and the potential for unintended consequences.