The Other Side of Hope

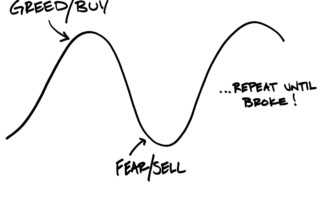

Hope is a positive emotion. It helps people to get through hard times. But hope can have a flip side: it keeps people from walking away from bad situations when they should. When it's time to sell losing stocks, as explained in this article, the hope to break even might make investors end up in a worse financial situation.