By Krystle McGilvery

When we think about wellbeing, we often think about our health, including our mental state. Research has found that good financial health has a huge influence on improving overall wellbeing, while poor financial health is linked to stress, depression and lack of productivity. People in receipt of financial education often report feeling more confident, more in control of personal finances and exhibit better financial behaviours. It is also important to note the added positive impact good finances have on the wider community and generations to come.

Today, financial wellness is an international issue, with more attention since the COVID-19 pandemic and the current cost-of-living crisis we are experiencing.

The pandemic saw people lose their jobs, business owners struggle to stay afloat due to closed doors and illness putting a strain on household finances. The cost-of-living crisis has caused people to be unable to afford daily expenses, buy property and plan, and is conflated with low levels of financial confidence and literacy.

Low financial capability is a global pandemic in its own right, affecting daily lives, the economy as a whole and even shaping the fortunes of future generations. The route to improved financial capability requires a holistic diagnostic approach.

The Increasing Need for Financial Wellbeing

Low financial capability has been a hot topic across the world for years and is an ongoing work in progress. One of its components, financial literacy, is yet to become a compulsory subject in UK schools, meaning many charitable and private organisations, such as The Money Charity, UK Strategy for Financial Wellbeing, MyBnk, are working hard to fill the gap. Unfortunately, the results of financial literacy programmes are mixed.

Behavioural economics has been used widely to explain the low effectiveness of financial literacy initiatives and the reasons for the poor financial decisions people make.

The state of the current economy has changed spending habits due to increased costs, increased unemployment and heightened the levels of worry amongst the public. Humans are uncomfortable with uncertainty, creating an instability within and a feeling of insecurity. In times of economic uncertainty, people tend to act more irrationally, exhibiting behaviours such as action bias and avoidance – all having a negative impact on finances.

Both independently and through collaboration, organisations and Government are working to support those that are struggling during this time, creating initiatives that will have a lasting positive impact on the levels of financial capability and wellbeing. Below I discuss how behavioural economics could be used to build effective financial literacy programmes.

More Than Just Financial Education

The first option often chosen as a method to improve financial wellbeing is improving financial literacy. This involves providing the learner with training on financial products and services available and guidance on how to manage a budget and debt, as well as differentiate between needs and wants.

However, many findings report that these programmes are not consistently successful. When administered, some witness no change in the financial behaviours of participants, and others witness some but with short-lasting change.

Many of the financial initiatives have not incorporated the psychological factors involved in improving financial capability.

The ignored psychological factors include: motivation, self-efficacy, self-belief. The understanding of these underlying factors could potentially act as a barrier to changing financial behaviour. If an individual is not in the correct frame of mind to learn, and does not have the intention to change their financial behaviour, they are unlikely to learn.

The Theory of Planned Behaviour is a framework used to predict an individual’s intention to change their behaviour. It considers the individual’s attitude, subjective norms and perceived behavioural control as key factors to gauge intent to change.

The framework identifies how intent an individual is on improving their (financial) behaviours. This framework is useful in helping to determine if a financial literacy programme is the best course of action, and in cases where it is not, what to focus on instead.

A Financial Wellbeing Framework

Intent to change behaviour is only one of the factors within the sphere of behaviour change. Other factors must be considered to seek lasting financial behaviour change. Financial capability encompasses accessibility, education and attitude, and here we focus on attitude.

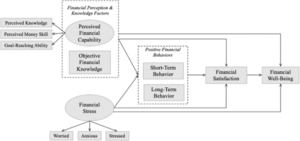

Recent progress in developing a financial model to support improved financial wellbeing includes a financial wellbeing framework developed in 2021 (Figure 1). This framework identifies three main factors contributing positively to financial wellbeing: financial satisfaction, short-term financial behaviour and perceived financial capability. Conversely, stress and long-term financial behaviour are directly and negatively associated with poor financial wellbeing.

Figure 1. A Structural Determinants Framework for Financial Well‑Being

This framework encompasses intent through perception of financial capability. This measurement may also factor in individuals’ attitudes to improved financial behaviour change.

The model identifies a range of factors involved in the maintenance of financial wellbeing and can have a significant effect on theinterventions we see today. The model looks to be a good foundation for identifying areas of friction requiring attention to improve financial wellbeing and change behaviour.

The factors positively impacting financial wellbeing include:

Financial satisfaction

This is an individual’s current view of their level of financial wellbeing, crucial in understanding their frame of mind, and the measure may also encapsulate where they feel they are in relation to social norms. We tend to form judgements of ourselves based on what we imagine the norms are of others within the ‘group’ to be. The feelings reflected here directly impact overall feelings about financial wellbeing.

Short-term financial behaviour

The short-term behaviours exhibited by an individual are a positive factor in the financial wellbeing level of an individual. Short term behaviour includes whether the individual has emergency funds, pays their credit card in full and spends less than they earn. This behaviour measure is used to indicate whether someone is currently exhibiting good financial behaviours and potentially capable of continuing to do so in the long term.

Perceived financial capability

Connected with financial satisfaction is a measure assessing whether the individual believes they have good money management and financial knowledge and are able to achieve their goals. This measure allows for the extraction of the individual’s self-efficacy. If they hold low levels of self-efficacy, it is unlikely that they would be willing to make efforts to improve their financial circumstances.

Historically, these factors have not been incorporated into financial wellbeing initiatives, but studies are finding strong links connecting the psychological state of an individual to their general financial wellbeing.

A Holistic Approach to Financial Wellbeing

The findings reported in the study allow for the development of a holistic framework. The framework also adds to some findings showing that nudges are inadequate for the long-lasting behavioural change required for financial wellbeing.

With this in mind, the framework supports the need to develop solutions that incorporate psychologically boosting techniques, coaching and financial education. Financial behaviour-changing initiatives would have wider spread impact if they also focused on the individuals’ self-belief and intention.

As the need to support the public’s financial wellbeing is on the rise, organisations are seeking support from financial wellbeing expertise. Using a simple diagnostic tool to assess the target group’s psychological biases and actual and perceived financial knowledge would be one way to start the process. Critically, incorporating a holistic approach to financial behaviour change is imperative to improving financial capability.

This article was edited by Ankit Shanker.